Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

fixed-incomecfa-level-2

14 Jul 2021

Credit scores and ratings are ordinal rankings used to classify credit quality. However, they do not explain the extent of the difference in quality between rankings.

Credit Scores

A credit score gives a snapshot of an individual’s credit risk at any given time. Smaller businesses and individuals utilize credit scores. Higher credit scores indicate better credit quality.

Roughly 90% of lenders to retail customers in the United States use the FICO score to determine a borrower’s creditworthiness. These scores range between 300 and 850.

A FICO score incorporates five factors to calculate an entity’s credit score. They are weighted as follows:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- New credit and recently opened accounts (10%)

- Types of credit in use (10%)

Since credit scores provide an ordinal ranking of a borrower’s credit risk, an individual, say A, with a credit score of 700 is considered less risky than an individual, B, with a credit score of 350. Note that we cannot say that A is half as risky as B.

Banks prefer lending to customers with a high FICO score. Fico scores are higher for borrowers with:

- A wider variety of credit types used.

- Longer credit history.

- Payment history (No delinquency, bankruptcy, court judgments, or foreclosures).

- Lower credit utilization.

- Fewer credit inquiries.

It is worth noting that the economic conditions prevailing during a given period do not influence credit scores, and the probability of default can be different among different loan types. Further, creditors lend based on credit scores, type of loan, proof of income, and/or length of employment, among other things.

Credit Ratings

Credit ratings are issued for corporations, government, and quasi-government bonds. They provide an ordinal ranking that incorporates both the default probability and the loss given default. Major credit rating agencies include Moody’s, S&P, and Fitch.

A higher credit rating reflects a better credit quality and vice versa. Higher-rated bonds trade at lower spreads relative to their benchmark rates. Credit rating agencies adjust the issuer’s rating for different classes of debt issues, a process called notching. This explains why the loss given default (LGD) varies between debt classes issued by the same borrower. The LGD is higher for less senior debt issues.

The credit rating agencies assign a letter grade, e.g., AAA, and provide an outlook for the issuer. Further, they highlight which issuer to keep watch over.

Advantages of Credit Ratings

- Simple to understand.

- Summarize a complex analysis in one metric.

- Tend to be relatively stable over time.

- Lower volatility in the debt market.

Limitations of Credit ratings

- Credit rating does not adjust with the business cycle, even though the probability of default changes with the business cycle.

- Conflict of interest may arise where the issuer compensates credit-rating agencies; this manipulates credit ratings’ accuracy, making the ratings less reliable.

Question

The FICO Credit score is least likely influenced by:

- Current economic conditions.

- Payment history.

- Length of credit history.

Solution

The correct answer is A.

The current economic conditions do not influence credit scores.

B and C are incorrect. A FICO score incorporates five factors:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- New credit and recently opened accounts (10%)

- Types of credit in use (10%)

Reading 31: Credit Analysis Models

LOS 31 (b) Explain credit scores and credit ratings.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

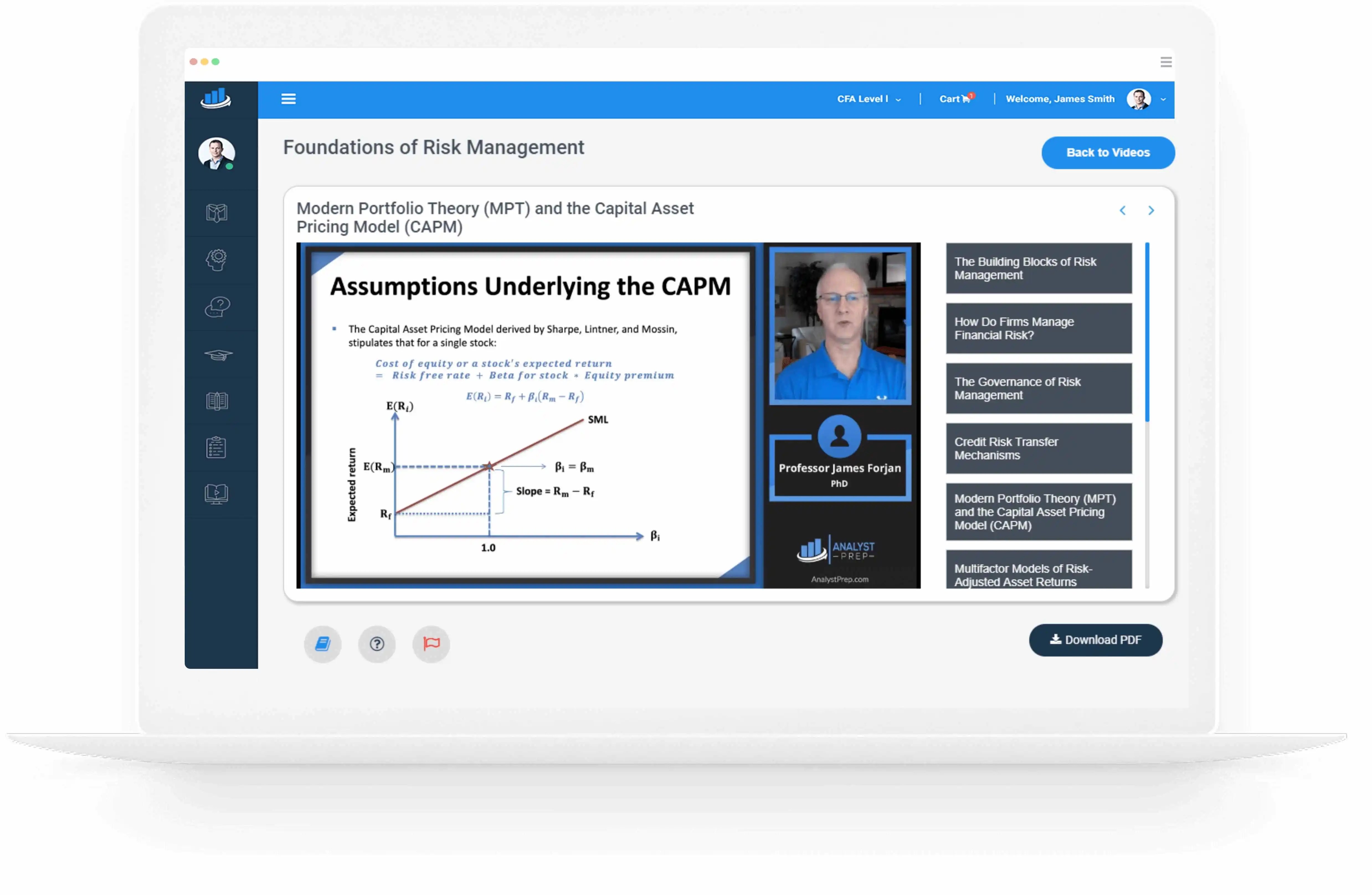

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Nyka Smith

2021-02-18

Every concept is very well explained by Nilay Arun. kudos to you man!

Badr Moubile

2021-02-13

Very helpfull!

Agustin Olcese

2021-01-27

Excellent explantions, very clear!

Jaak Jay

2021-01-14

Awesome content, kudos to Prof.James Frojan

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Trustpilot rating score: 4.7 of 5, based on 61 reviews.

Related Posts